Easily Get Rid of Most (or all) TransUnion USA Credit Inquiries!

Credit inquiries fall into two types: hard and soft. Hard inquiries impact your credit, and occur whenever you make an application for credit. A couple hard inquiries a year presents no problems, but a number of inquiries makes you look like a credit seeker to creditors, which can substantially impact your credit rating. Soft inquiries occur for promotional offers or when you check your own credit, and have no impact on your credit bureau. A trick has been floating around the internet on how to get rid of your hard credit inquiries with TransUnion in the United States, and it seemingly works!

What Happened

This past summer, there were reports all over credit forums of people looking at their report and having no hard credit inquiries, and shortly thereafter, those inquiries returned to their report. It seems that TransUnion USA, a credit bureau often used by American Express and a number of other creditors, had a technical glitch whereby hard credit inquiries were removed and then put back on a credit bureau.

The Theory

As always, I am not a lawyer, and you should always consult with licensed counsel regarding any legal questions.

The Fair Credit Reporting Act (‘FCRA’) regulates credit bureaus in the United States, including TransUnion. It establishes rules for reporting, and specifically, § 611 5(b) of the FCRA covers a credit bureau’s requirements relating to the reinsertion of previously deleted information on an individual’s credit history. It states that if information was removed pursuant to a consumer dispute, that information cannot be re-added to a credit bureau.

Now, the theory is that when the glitch caused credit inquiries to be removed and then re-inserted, TransUnion was in breach of FCRA § 611 5(b). I don’t totally agree with that interpretation, as the text of the law only bars the re-insertion of information deleted as a result of a consumer dispute. However, as noted below, there are a number of reports of people having their inquiries removed quoting this rule, so perhaps my interpretation is incorrect or TransUnion doesn’t fully understand the law, or wants to air on the side of caution.

In Practice

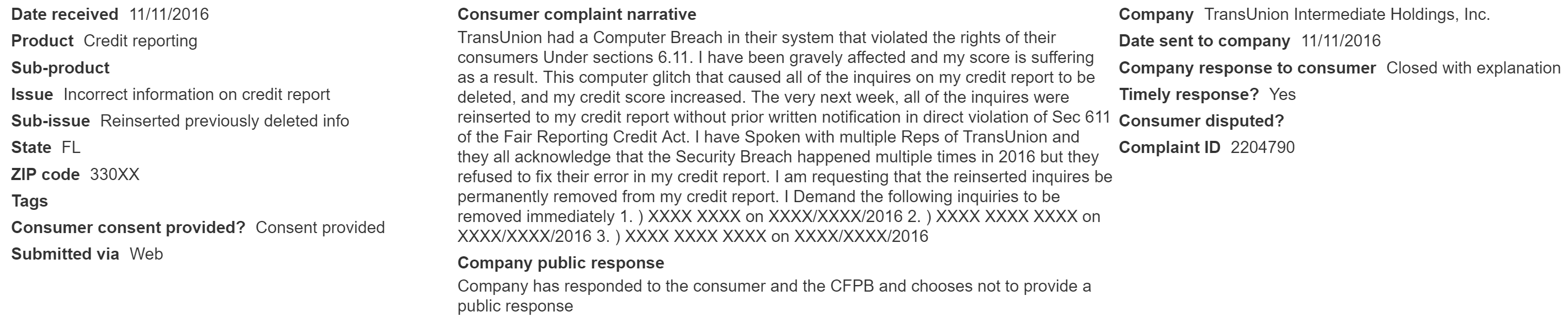

There are dozens of reports floating around the internet of people calling TransUnion and referencing the glitch, which is apparently relatively universal, and speaking with the Special Handling Department. When quoting FCRA § 611 5(b), the TransUnion agent manually deletes all or most of the individual’s hard credit inquiries. Further, there are reports of people being told they weren’t affected by the glitch, only to file a complaint with the Consumer Financial Protection Bureau (‘CFPB’). At the CFPB, there are numerous reports of success. When looking through the publicly accessible CFPB database, a number of claims can be found:

Conclusion

Having all of your TransUnion hard credit inquiries removed is huge for churners. This will dramatically improve some scores, and make it substantially easier to apply for credit cards. If you believe you were impacted by this glitch, which it seems like most people were, you might want to work with TransUnion to get your hard credit inquiries removed.

And this is relative as a Canadian blog because…?

Your tag is “a Canadian blog for travel deals”. When might a come here and read about some?

Sammie, you’ll notice my blog is progressing as a Canada – USA blog. I’m doing this because, as you may know, I’ve written about how Canadians can get US credit cards, and many of my readers have done so. I provide advice / guidance for those individuals. Further, to be frank, it’s my blog and I’ll write about whatever I feel like

Edit: also, you’ll note I specifically put “USA” in the title. I did this so as to not “trick” Canadians without US interests into reading it.

Regarding your comment that many of your Canadian readers have received US credit cards, I’ve gone through your site and haven’t come across any “success” stories. Can you point me in the right direction? Any readers out there – please share your success stories as I would like to see how you have done it.

Should have gone to PointsU 😉

Maybe next time. Til then, I’ll wait until the success stories roll in here.

I haven’t head any success stories either. Asked a bunch of question on the post about it but to no avail.

Most of those who have had success (myself included) are not usually flocking to internet message boards to talk about it, although there is plenty of that out there too on the biggest sites that can easily be looked up.

Someone has their thong in a bunch. Jeez, Thank You for writing this piece DCTA!

thanks for the article. Do you know what phone number to use?

I’m personally trying the CFPB route. Just google TransUnion’s general number and ask to speak to special handling department

Here’s a data point:

Called yesterday and got through to the special handling department and was told that I was not impacted by the glitch and to dispute a hard inquiry on my report, I would have to submit documentation.

I was also told the same thing. I was informed that the glitch happened between April 1, 2016 and June 15, 2016.

You can by-pass this warning in Chrome by clicking Advanced then Proceed to site.