I got caught manufactured spending! :(

I’ve quietly blogged about PayTm before, a Canadian payment app backed by Alibaba. Essentially, the app lets you pay bills, including university tuition, using a credit card. While they normally have a fee, right now they’re running a fee-free promotion, with no published expiry date. You can use my promotion code PTM1158559 on PayTm.ca which will give each of us a $10 credit after you make your first $25 payment. On an app store, make sure you download the PayTm app that has a little maple leaf on the logo (there’s another one for the Indian market).

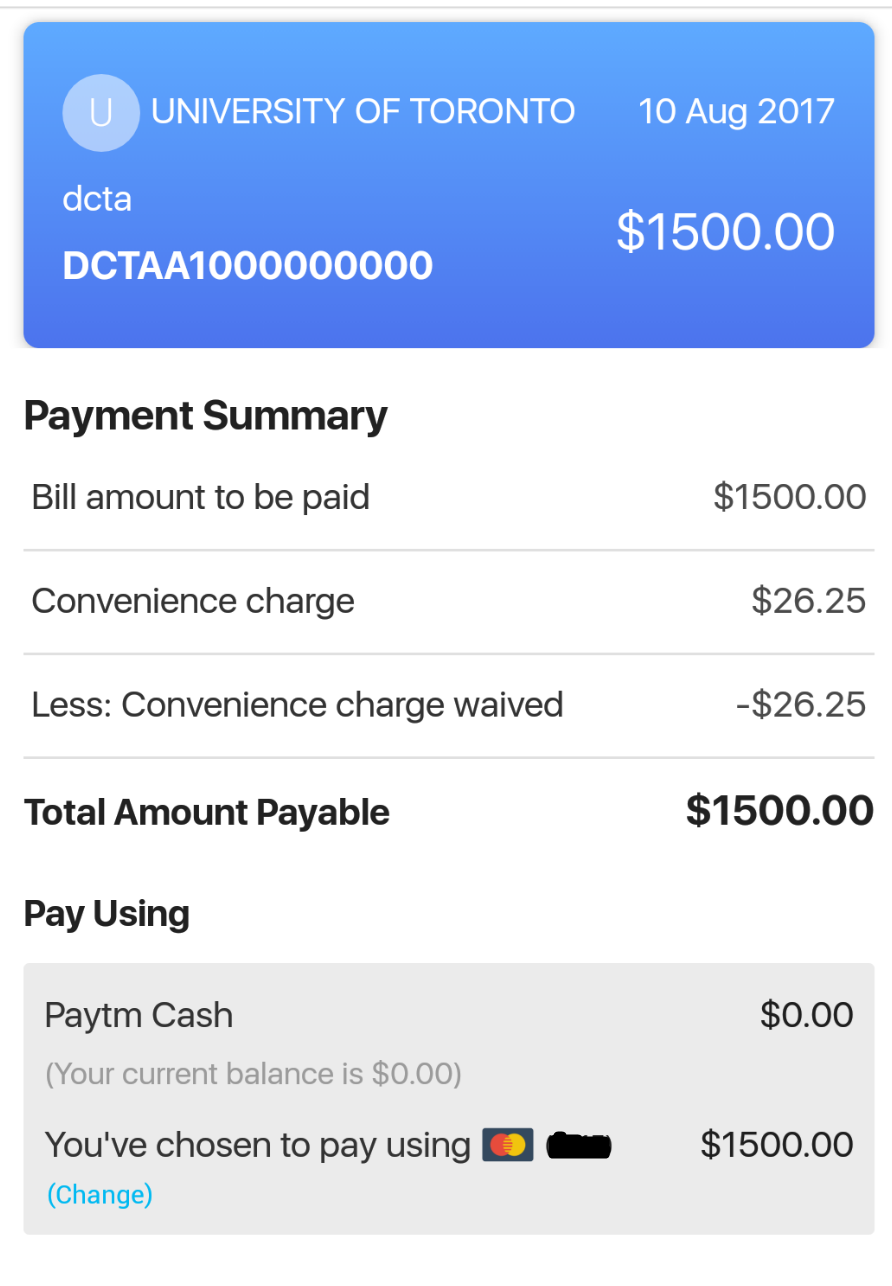

While this is an amazing promotion normally, allowing you to pay most bills (including property taxes, CRA, etc.) using a credit card without a fee, it’s also a great manufactured spend technique. I decided to use one of my previous universities to continually send payments through PayTm. That university would refund my account by e-transfer, which made this a phenomenal manufactured spend opportunity. I would pay my university using PayTm to a maximum of $1500 per day per account, it would hit my university account a couple days later, and I could process a refund shortly thereafter. Since PayTm accepts Visa, Mastercard, and American Express, it’s easy to earn valuable points quickly.

Getting caught

After quite a bit of manufactured spend, I received this email from the institution regarding my most recent refund request:

Your refund request has been declined for the following reason:

We are unable to provide you with a refund due to the recent activities on your student account. Please email us with your last two payment receipts and an explanation on you have been making payments with no course registration. You can email me directly at [REMOVED]. I am the Assistant Supervisor of the department.

I had a lot of money tied in the account. I know I’d get the money back at some point, as a third party can’t just hold your money without having an actual entitlement to it. However, there’s no reasonable way to explain my spending pattern, and I did want my money back quickly. I called the representative, explained exactly what I was doing. She seemed to understand and not care, so long as I promised to not do it again. She also said she’s monitoring a number of other accounts doing the same. So, not a big deal, but once caught, I won’t be able to do it again with this institution.

Regardless as to my experience, that’s only one of thousands of potential billers I can overpay and get a refund from. The game isn’t dead until PayTm closes the promotion. Will that be soon? I expect so. The fee-free promotion has lasted for months, and I suspect the company will at some point want to generate revenue, since they’re certainly operating at a loss right now absorbing the merchant processing fees.

Going forward

While I suspect there isn’t much time left to use this meaningfully for large manufactured spend, it’s still a phenomenal and free way to quickly meet minimum spend requirements on credit cards. Usually with these types of manfuactured spend opportunities, you’re limited to Visa/Mastercard. However, since PayTm accepts American Express, I would register for as many American Express cards with minimum spend requirements and meet those quickly with PayTm. These are some cards worth considering:

=> American Express SPG Personal – 25,000 SPG points (best available bonus) after spending $1,500

=> American Express SPG Business – 25,000 SPG points (best available bonus) after spending $1,500

=> American Express Business Platinum – 75,000 MR points (1:1 into Aeroplan) after spending $5,000

=> American Express Business Gold – 40,000 MR points (1:1 into Aeroplan) after spending $5,000

These are great cards to get with worthwhile signup bonuses, but spending $13,000 in three months is normally a difficult challenge for most of us. However, with PayTm, you can meet this goal within 9 days by overpaying a biller $1,500 a day and getting an overpayment refund shortly thereafter. Just don’t overdo it with one biller, like I did with my school!

This post contains affiliate links. Any link provided is the best available link. Your support keeps this blog running, and is greatly appreciated.

Sounds like it was just someone in the accounting department doing a good job of watching their transactions for anomalies (they probably have to report & explain giving refunds). Maybe try somewhere else with a higher volume of transactions that is likely to be more automated for refunds. Maybe “pre-pay” the balance on a different card…

How hard is it to just say you had an autopay on and forgot about it?

Smarter man than myself…. 🙁 oh well!

DCTA, is there a list of universities to choose? TIA

Nope. Just scrolls though them on the app.

Did you have an account # for your university payment?

Yes

Which was still active even though you weren’t attending university anymore? Not sure my 15 year old account # would still work!

It worked at a university I didn’t attend for a long time

So you learned a lesson about keeping your mouth shut when you find a good angle for future MS?

Nah my mouth is too big.

Can you pay a different credit card bill?

Only the staples card I think.

Pretty new at this…can you avoid paying the annual fee for a credit card (like some of your links listed above) by closing the account after you’ve reached your reward level (like spend 5000$ in 3 months)?

With Amex, you can get a refund within month 1. So yes, possible, but Imo you should pay the fee.

Thks

You will probably wont get the points if you cancel the card this way.

Does this work in U.S.? Or is there a way for someone in U.S. to take advantage of this PayTM promotion?

You may be able to change your billing address to a Canadian address, however, you’ll get your refund in Cad which may be a pain without a Canadian bank account

Any risk of a biller not issuing a refund? Was thinking of trying this with CRA. Did you try other billers besides the university?

I’d be hard pressed to think of a biller that wouldn’t… It would be odd. No I did not.

Must be an amazing institution with superlative employees, to catch that 😉

You guys spend all so much time generating miles without actually earning them, and then complain when the airlines devalue the miles. You are ruining the frequent flyer programs for people that don’t have the time or energy for all the games you play.

Then you really shouldn’t be reading blogs about gaming. Kinda hypocritical.

How does it feel to be a parasite?

Fattening.

How did the University know how to contact you for a refund?