How to Transfer Money From Canada to the United States

If you’re one of the (smart) Canadians who has US credit cards, you’ll feel the struggle of paying them off. You can’t pay US credit cards with Canadian dollars. At some point, you need to convert Canadian dollars into US dollars, which will always have a conversion fee.

In this post, I’ll explore and rank my preferred methods of transferring Canadian dollars to US dollars to pay US credit cards.

1 – Transferwise

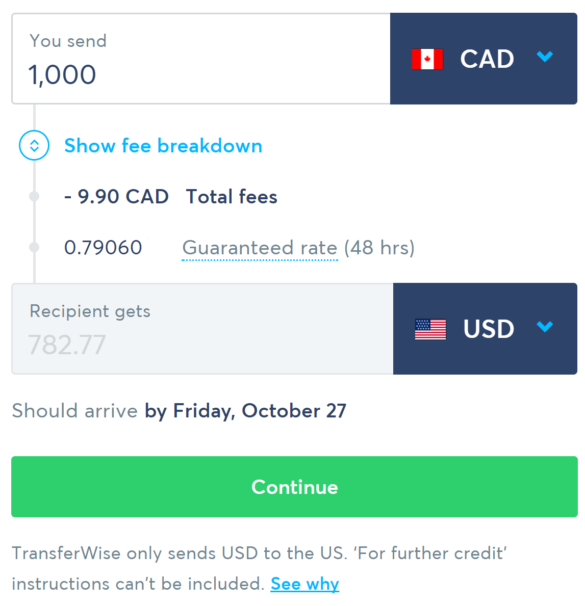

Transferwise is a UK-based company that facilitates currency transfers to dozens of currencies, including Canadian and US dollars. It offers the best balance of convenience and price. They charge a ~1% currency conversion fee, which means for every $CAD 1 you convert to USD, you’ll lose approximately one cent to Transferwise.

The cheapest way to use Transferwise is by direct debit from your Canadian account, which then deposits the funds into your US-based account. This normally takes up to a week, so it’s important to plan your US bill payments accordingly.

2 – TD Canada Trust Visa Direct

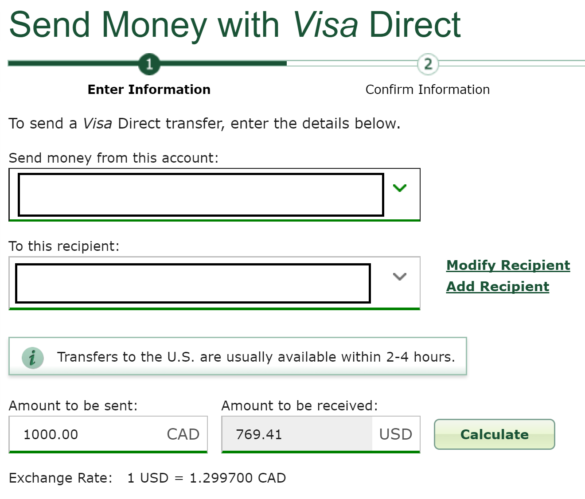

I use TD Canada Trust in Canada, and opened a US-based TD Bank (USA) account online. I know RBC has a similar service, but I don’t use RBC (USA), so I can’t speak to their service.

If you have a TD account in Canada and the US, you can transfer funds instantly online from Canada to the US using Visa Direct. It appears that this costs ~ 2.7%. While this is more expensive than Transferwise, transfers are instant. If you’ve forgotten to pay your bill or are running out of time, this should be your back-up option.

TD reimburses the transaction fee, but the foreign exchange fee still applies.

3 – Norbert’s Gambit

Norbert Schlenker, a BC-based investment manager, invented what many call the Norbert’s Gambit. This is by far the cheapest method to convert Canadian dollars into USD, but also the most laborious, and best reserved for large transfers.

First, you need an investment account, the best being RBC Direct Investing which lets you complete Norbert’s Gambit online.

Essentially, you’re going to buy US dollar listed ETFs in Canada, sell them, and then use the proceeds to buy US listed ETFs. PWL Capital has a great step-by-step guide on how to use Norbert’s Gambit. Your fee can be as low as ~ 0.20%, which is by far the cheapest for any currency conversion option that I know. However, it’s rather complex, and frankly only worth the time if you’re transferring large amounts to the US.

In Summary

My favourite option to convert Canadian dollars to USD is with Transferwise, because it balances cost and convenience better than other options. If you bank with TD, their Visa Direct program gives you same-day transfers, but they are the most expensive of all options. Finally, if you’re transferring large sums, you should look to use Norbert’s Gambit to save the most on currency exchange fees.

Do you have a favourite option to convert Canadian dollars to USD?

http://www.xe.com/xemoneytransfer/us/

How about Knightsbridge?

You can do a wire transfer directly from a Canadian (or any) bank to Visa. Just ask Visa for the wire transfer instructions. The sending bank will send in US dollars (converted at the bank rate which is usually the best) if so instructed. No fees except for the standard wire transfer fee.

how do you contact visa for the wire transfer instructions as you said ?

This is bad advice. The bank rate will be 2-3% off of the market rate.

I feel like this was addressed in the article.

I’ve tried them all (Transferwise, MTFX, CanadianForex, Knightsbridge, TD Visa DIrect, XE), and the cheapest is VBCE.

Oh, and it’s called Norbert’s Gambit!!!

Knightsbrige only charged around 0.5% over the spot price. Very easy – you pay them via a bill payment, and they EFT’d the US Funds to my TD Canada Trust USD account a few days later (which you can then instantly transfer to TD Bank).

I’ve used Currencyfair and gotten a 0.35% spread, but maybe I was lucky. What about cash ATM withdrawals from a Tangerine account at a Bank of America in the US and redeposit? Easiest if you have a BofA account and will only work for small amounts and of course you have to be physically in the US. I have done the reverse USD-CAD with my no Forex fee or ATM fee CapOne US bank account (these no fee terms are grandfathered).

Tangerine charges a hidden 2.5% spread for foreign currency ATM withdrawals made using their debit card.

With TD Crossborder banking, the fees are waived between TD Cdn accounts and TD USA accounts. That would make this the cheapest option and with instantaneous transfers, it is easy. THe only limitation is that visa direct limits the transfer to $2500 per day, so if you need to do a larger amount, it will need to be done by phone.

Even with TD Crossborder the exchange rate they give you will include a hidden fee via giving you a rate a bit off the market rate. From what I remember it’s a smaller upcharge then if you don’t have crossborder, but it’s still not great.

I have successfully for many years used the RBC system with bank accounts on both sides, a RBC Bank USD Visa, and purchasing USD via Knightsbridge, who only charge very little to convert and deposit money in a couple business days. I use the banking bill payment system and they deposit the money, easy peasy. This was for varying amounts as well, but Knightsbridge minimum is $2000 USD, the only disadvantage I can see if you need smaller amounts.

Have a friend who works at a bank and gets the employee rate…